Tin tức

Reciprocal Deposits as well as the Banking Disorder of 2023

Blogs

But it is along with true that there isn’t any rates to help you render a claim no chance. And also for the bulk from plaintiffs, submitting a state demands restricted work. One to difficult issue is actually that they have been too little to the Army’s holding case. However they generated the new fit of a great soldier’s helmet somewhat of a problem. The fresh nonlinear twin-ended Combat Hands Earplug Adaptation dos (“CAEv2”) are meant to protect pages because of the selection peak-level music. They certainly were created by Aearo Innovation, which eventually marketed the business in order to 3M.

A judge inside Mali for the Saturday refused a destination because of the Barrick Mining to produce five group arrested past November, increasing a lengthy-powering standoff involving the Canadian company and Mali’s bodies over fees and you can mining ownership, told you Reuters. In order to enhance FDIC exposure past 250,100000, depositors provides some other choices in addition to believe accounts. The brand new service is additionally revising standards to own relaxed revocable trusts, called payable to the passing membership. Previously, those profile had to be entitled which have a term such “payable for the passing,” to get into believe publicity limits. Now, the fresh FDIC won’t have that specifications and you will as an alternative merely need bank facts to spot beneficiaries to be sensed relaxed trusts.

- Greg McBride are a good CFA charterholder with well over 25 percent-millennium of expertise considering financial style and personal finance.

- Common Direct doesn’t give specialty Cds, such as bump-upwards or no-penalty Dvds, though it possesses a checking account having an aggressive speed.

- Congressional management as well as the Chairman have finally enacted other COVID recovery stimuli plan to your rules.

- Immediately after considering every piece of information gained in the verification processes, the brand new Commission did not pick one financial otherwise moral integrity questions who does need after that explanation thanks to a public hearing.

HSA Withdrawals

The money are applied and you can paid by the state jobless businesses. Which means you would have to get in touch with them when you’re that have problems with these types of costs. “Moreover, any company that is willing to expand that sort of bond to help you Trump would probably consult a highly highest commission percentage so you can undertake you to exposure.” Protecting a keen appellate bond function a pals vouches the new punishment often sooner or later be paid if the an is attractive legal upholds they. Securities are generally supported with a mix of dollars and you will possessions for guarantee equivalent to 110percent of your overall judgment, and are came back in case your defendant victories for the desire. Highest noninterest money, simply because of seasonally large exchange funds, drove the fresh quarter-over-one-fourth improvement in return to the collateral.

Carryback/Carryforward Claims and you can Software

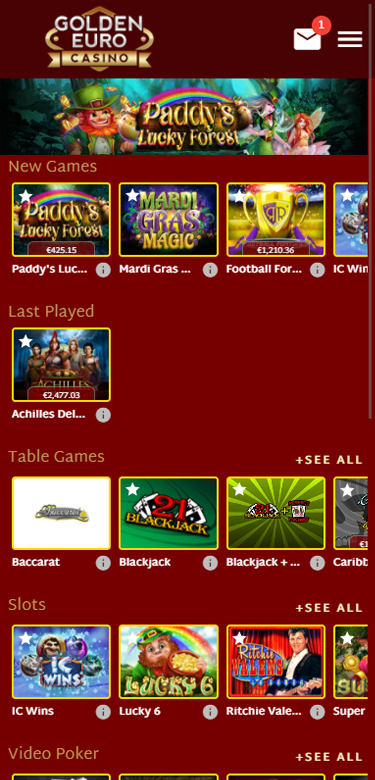

Reciprocal deposits is actually dumps replaced between banking institutions to efficiently boost put insurance. Their fool around mr bet nz reviews with became somewhat within the banking disorder out of 2023. That it Economic Reviews describes what they are, their link with brokered deposits, just how its court procedures has changed through the years, and you can and this banks make use of them by far the most.

Lender Industry Indications Provides Deteriorated

From the phone thanks to the woman courtroom representative and you can agreed upon a visit in the said address for the 7 February 2018 but on that day the brand new agents was came across from the a person stating becoming Ms Meters.’s dad just who informed him or her you to definitely Ms M. Is to stop connection with the child security authority while the she performed not want to be found and now have their kid eliminated. The fresh authority registered they had exhausted the function available for establishing the little one’s whereabouts and they you are going to perform an only-passions evaluation only when a court asked it. The changes would force financial institutions to exchange internal patterns for lending and you can working exposure which have standard conditions for everyone financial institutions having at the very least 100 billion inside the assets. They’d also be forced to explore a few solutions to assess the new riskiness of the issues, then conform to the higher of the two to own investment objectives.

Claims was required to offer thirty days observe to the Us DOL just before ending the new PUA, PEUC, 3 hundred FPUC apps. In addition, it means these to ensure retroactive payments are made for the claims prior to this notice several months. Following the condition’s cancellation time zero the brand new or active allege money will be produced. Needless to say of numerous says remain experiencing high backlogs and you can deceptive says, making it questioned it might take several weeks for many states and make right back costs to have qualified weeks.

Opinions conveyed commonly necessarily that from the fresh St. Louis Fed or Government Put aside System. Jonathan Flower is the Federal Reserve System historian, a task based in the brand new Government Reserve Financial of St. Louis. He or she is in addition to an elderly economist and you will economic coach in the Federal Set aside Financial away from Chicago. Their look interests are You.S. financial records, the newest Provided and the domestic financial industry. “The newest incentives away from higher sophisticated loan providers to perform for the a good as well huge to help you fail lender.” Journal of Financial Balances, 2019.

![]()

Detailed advice because of it most distribution processes had been agreed to the newest direct plaintiffs’ lawyers to the Tuesday. To prevent logistical issues, the new legal has created specific due dates for those articles that will be prior to when those people to have individual submissions. This type of deadlines is April 22, 2024, for MSA III Wave Claimants and you will July 23, 2024, for MSA We Claimants, for both EIF programs and you can DPP supplementations.

Khuyến Mãi

Khuyến Mãi